The Single Strategy To Use For Simply Solar Illinois

Table of Contents8 Simple Techniques For Simply Solar IllinoisThe 20-Second Trick For Simply Solar IllinoisExcitement About Simply Solar IllinoisThe Facts About Simply Solar Illinois RevealedSimply Solar Illinois Things To Know Before You Get This

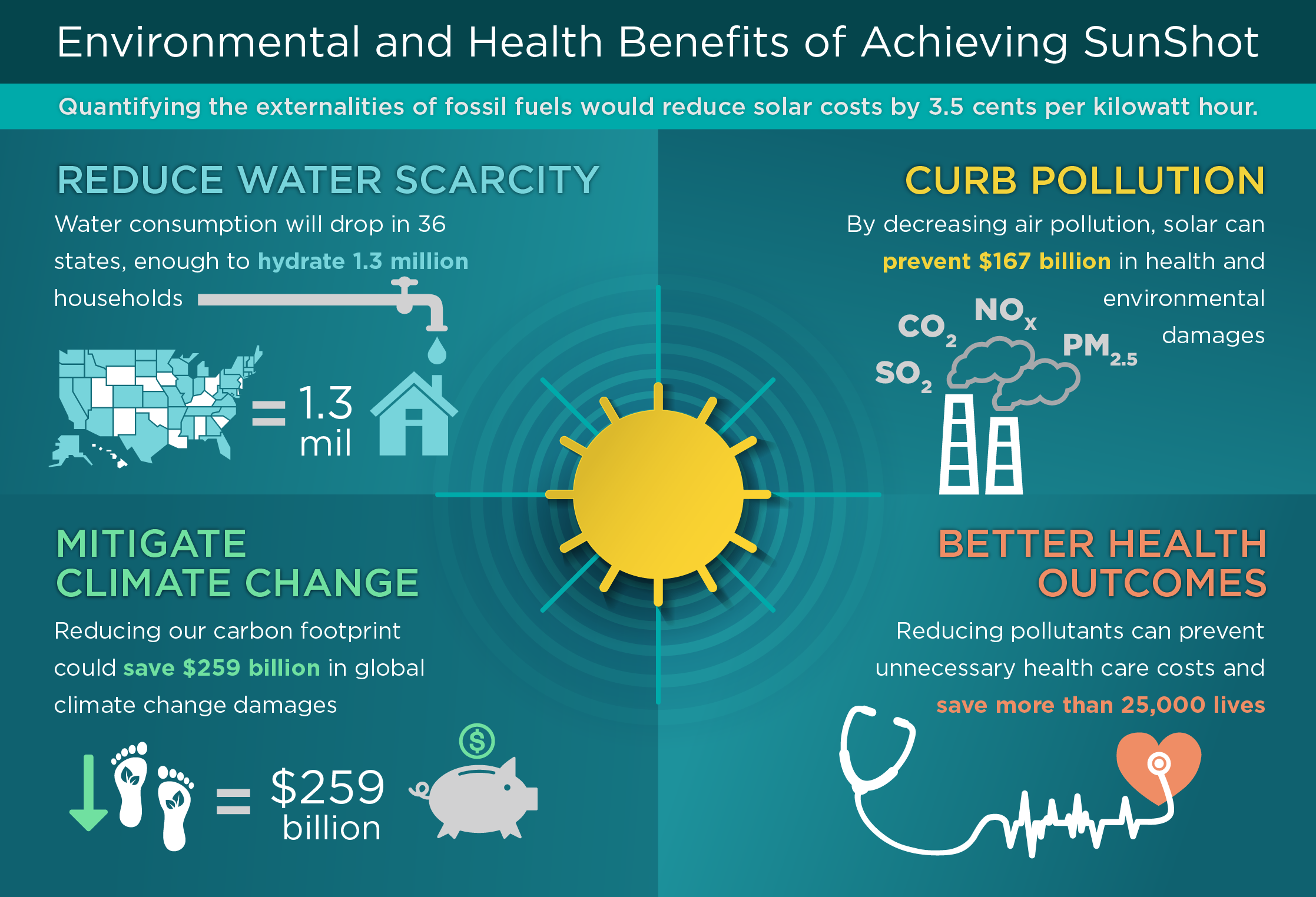

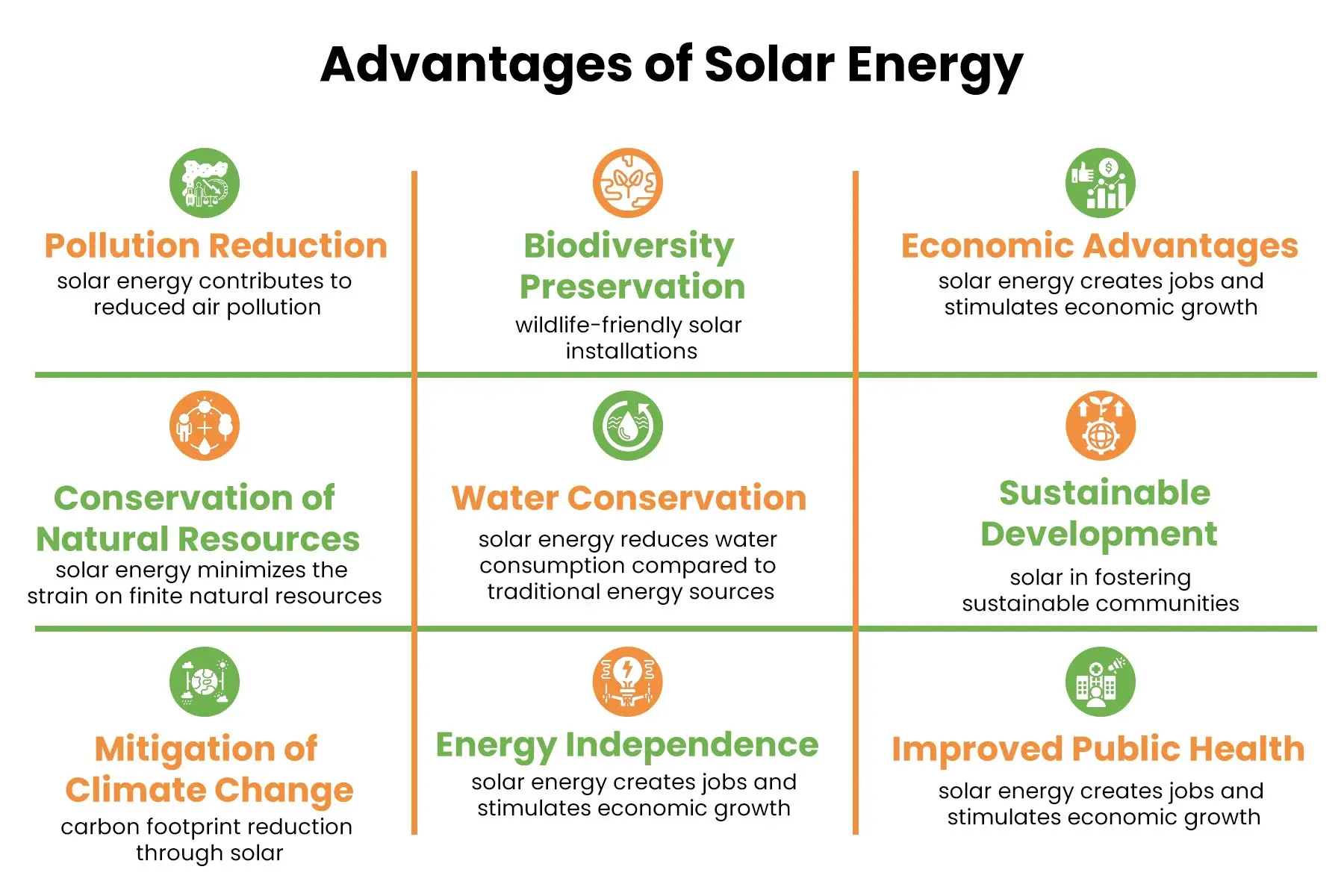

Our group partners with neighborhood neighborhoods throughout the Northeast and beyond to supply tidy, budget friendly and trusted power to promote healthy areas and keep the lights on. A solar or storage space task supplies a variety of advantages to the neighborhood it serves. As technology advancements and the cost of solar and storage decrease, the economic benefits of going solar proceed to increase.Assistance for pollinator-friendly environment Habitat reconstruction on contaminated websites like brownfields and land fills Much needed color for livestock like sheep and chicken "Land financial" for future farming use and dirt top quality improvements Because of environment change, extreme weather is ending up being a lot more frequent and disruptive. Therefore, home owners, businesses, neighborhoods, and energies are all coming to be increasingly more thinking about protecting power supply options that offer resiliency and energy safety.

Ecological sustainability is another crucial chauffeur for services buying solar power. Several companies have durable sustainability goals that consist of minimizing greenhouse gas exhausts and utilizing much less sources to aid minimize their impact on the natural surroundings. There is a growing seriousness to deal with environment modification and the pressure from customers, is reaching the leading levels of companies.

Simply Solar Illinois - Questions

As we approach 2025, the assimilation of solar panels in industrial projects is no more simply an alternative yet a critical necessity. This blogpost explores exactly how solar power jobs and the multifaceted benefits it gives commercial structures. Solar panels have been made use of on property structures for years, but it's only recently that they're coming to be a lot more usual in business construction.

In this short article we review exactly how solar panels job and the benefits of making use of solar power in industrial structures. Electricity expenses in the United state are raising, making it a lot more pricey for organizations to operate and more tough to prepare in advance.

The U - Simply Solar Illinois.S. Power Info Management expects electric generation from solar to be the leading resource of growth in the U.S. power industry through the end of 2025, with 79 GW of brand-new solar ability projected to find online over the following two years. In the EIA's Short-Term see this Energy Overview, the company stated it anticipates renewable resource's total share of electrical energy generation to climb to 26% by the end of 2025

The Basic Principles Of Simply Solar Illinois

The sunshine triggers the silicon cell electrons to set in movement, developing an electrical present. The photovoltaic solar cell absorbs solar radiation. When the silicon interacts with the sunlight rays, the electrons begin to relocate and develop a circulation of direct electric existing (DC). The cords feed this DC electrical power right into the solar inverter and transform it to rotating power (AIR CONDITIONER).

There are several ways to store solar power: When solar energy is fed into an electrochemical battery, the chemical response on the battery parts maintains the solar power. In a reverse reaction, the existing departures from the battery storage for consumption. Thermal storage makes use of mediums such as liquified salt or water to preserve and take in the heat from the sunlight.

Solar panels considerably reduce power expenses. While the first investment can be high, overtime the cost of mounting solar panels is recouped by the cash conserved on electrical energy expenses.

Indicators on Simply Solar Illinois You Should Know

By mounting photovoltaic panels, a brand name shows that it cares regarding the atmosphere and is making an initiative to minimize its carbon footprint. Structures that count totally on electrical grids are at risk to power outages that occur throughout poor weather or electrical system breakdowns. Photovoltaic panel set up with battery systems allow commercial structures to remain to operate during power failures.

Simply Solar Illinois Fundamentals Explained

Solar power is among the cleanest kinds of power. With lasting guarantees and a production life of as much as 40-50 years, solar investments contribute dramatically to ecological sustainability. This change in the direction of cleaner site here energy resources can cause more comprehensive financial advantages, including lowered climate change and environmental degradation expenses. In 2024, homeowners can gain from federal solar tax motivations, permitting them to balance out almost one-third of the purchase price of a planetary system through a 30% tax obligation debt.